What Should I Register My Business As

"Regulatory paperwork is fun," said no i ever. Simply registering your business is an exciting step in your entrepreneurial journey. And if you know where to expect, at that place are plenty of resources out there to make the process painless, if not exactly entertaining.

And so let's dig in and walk through the steps required to make your business official.

Not all businesses are required to register with the state. Sole proprietors and concern partners can outset a business and operate for years without registering a business entity.

They tin can build a website, hire employees, and go correct on doing business, arresting the profits from their enterprises as personal income. Under this system, there is no legal business entity. The business organisation is inseparable from its owners.

This is the simplest and most common business organization. As businesses abound, nevertheless, it makes sense to establish a business entity by registering with the country.

The main advantage of registration is that it can shield owners from the potential legal and financial liabilities of the business. It tin can also help your business access loans and operating majuscule to aggrandize sales and enter new markets.

Registering your business takes a chip of enquiry and paperwork, merely it is something you can manage on your own.

Depending on the complexity of your concern, your operating footprint, your sales tactics, and the types of products or services you offer, you may demand guidance from taxation and legal advisors at various points in your journey from solopreneur to fully registered business entity.

Y'all can likewise hire attorneys or compliance companies to manage business registration for you if you'd rather focus your time and energy on more fulfilling aspects of running your business.

Here are the seven steps in the process of registering a minor concern:

- Choose a proper noun

- Choose a structure

- Make up one's mind on a country of domicile

- Register with the secretary of country

- Engage a registered agent

- Register for taxes

- Acquire licenses

How to get your business concern registered

Registering your business requires filing registration paperwork with the secretary of land or corporations bureau. You can find a direct link to your state's corporate registration dominance from the National Association of Secretaries of State website.

While each state has a unique registration process, they all follow the aforementioned bones steps.

Step 1: Choose a proper name

Your name is of import to your business'southward destiny. It's your customer's first impression of your concern and helps bring them to your door. Names above in the alphabet do good from summit billing in directories.

If you lot can figure out how to fit "aardvark" into your business proper noun, that may piece of work to your advantage. More importantly, though, your name should reverberate your vision for your brand and be unique in your manufacture.

To register business names, consider the following:

- Name availability: Every state has its own naming standards to ensure that business names are distinguishable from 1 another. Before you file any state paperwork, you demand to carry a name availability search to ensure that your chosen name isn't already taken. Many states provide a tool for conducting your search online.

- Name rules: States also take industry-specific quality controls for naming. For example, New York publishes a listing of prohibited and restricted words for business names. Some name requirements are based on industry or profession. Information technology's up to you to cheque for these restrictions and choose an available name to avoid having your paperwork rejected.

- Need for a fictitious name: When registering your business in new states, if your existing business name is unavailable, yous may need to register a fictitious or "doing business organization as" (DBA) name.

Pace 2: Cull a business structure

You tin register a business equally a partnership, an LLC, or a corporation. You can further choose to be taxed as an Due south corporation, but that is a tax ballot split from concern registration.

Corporations and LLCs both provide express liability protection. A major differentiator between LLCs and corporations is that LLCs allow you to take advantage of pass-through tax, in which the company'due south profits pass through to the owners as personal income.

This simplifies your tax filings and may lower your tax bills. Corporations may elect S corporation status, however, which allows them to be taxed equally a pass-through entity.

Which structure provides the best revenue enhancement reward for your business concern depends on your specific circumstances. Information technology is more often than not wise to consult a tax counselor to evaluate your options.

Following are factors beyond liability and taxes that help determine the best entity type for your business.

When choosing a legal business concern structure, consider the following:

- Availability: Each state has its ain set of permitted business organisation structures. Y'all'll need to consult the secretary of state website to determine permitted structures and their limitations.

- Complexity: Corporations are more complex to form and maintain than LLCs. This complexity allows them to support unlimited growth.

- Costs: Considering of their increased complexity, corporations are more expensive to form and maintain than LLCs.

- Fiscal capacity: Corporations can take reward of investment capital letter to grow. LLCs may accept a harder time accessing funding.

- Control: LLCs allow owners to continue to play an agile role in the business concern. Corporations distribute ownership and management of the visitor among shareholders and directors.

Stride 3: Choose your state of domicile

The land where yous initially register your business concern is your dwelling house land or state of home. In your home state, your business concern is a domestic firm.

Yous don't take to class your business in the state where yous're located. Many businesses cull to incorporate in Delaware because of its very business-friendly legal and regulatory environment.

It has a separate court system devoted to hearing corporate cases. Nevada is a popular choice because of its low business taxes.

Yet forming your business in a different land introduces a lot of actress complexity to your business organization. Instead of i land of regulatory filings, fees, taxes, and potential penalties to stay on top of, yous now take two. Generally, it makes sense for small businesses to select home equally your state of domicile.

The post-obit factors can assist you determine where to register your concern:

- Taxes: Every state imposes a unlike mix of personal income taxes, corporate income taxes, franchise taxes, and sales taxes. According to the Tax Foundation's 2020 Business Revenue enhancement Climate Index, states with the worst business organisation taxes are New Bailiwick of jersey, New York, California, and Connecticut. At the meridian of the list for most favorable concern tax climates were Wyoming, South Dakota, Alaska, and Florida.

- Regulatory brunt: Some states are friendlier to businesses in their legal systems, their regulatory requirements, or both. Delaware is a good instance of the old, as noted higher up. Texas, Florida, Tennessee, and North Carolina rank high with executives for their business concern-friendly environments.

Step 4: Annals with the secretary of state

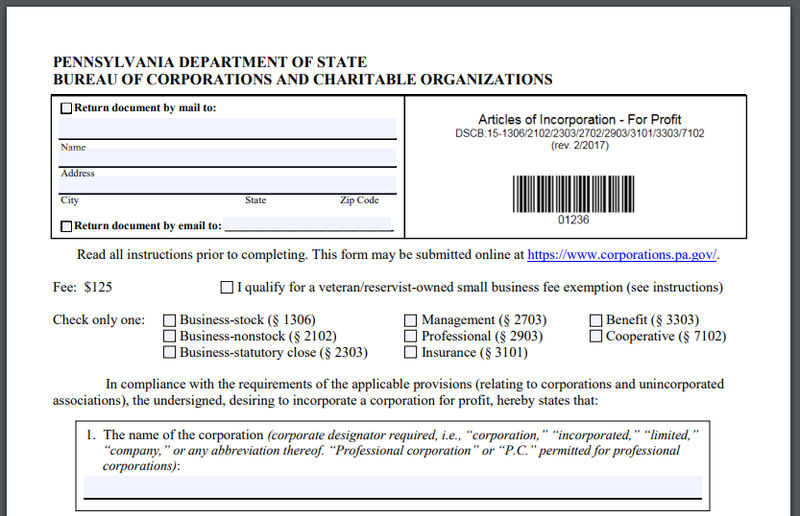

In your home country, registration will require filing formation paperwork. For corporations, this typically includes appointing a board of directors, writing bylaws that outline how the business concern will exist run, and submitting articles of incorporation to the state along with a fee.

You tin find templates for bylaws and other governing documents online if you want to handle formation yourself. States typically provide awarding forms on their websites with instructions for attaching required documents.

You can find registration materials and filing instructions on your secretary of state or corporations bureau website.

Paperwork for LLC registration is like. To create an LLC, you must typically file articles of organization along with any required documents with the secretary of country.

The governing document of an LLC is its operating agreement, which outlines the rights, responsibilities, and ownership shares of all members. Some LLC owners choose to appoint a lath of directors, though this is uncommon.

Many states have a portal that lets you lot file these documents electronically. Others require a paper application submitted with a check.

Filing fees for domestic LLCs and corporations range from a low of $40 in Kentucky to $500 in Massachusetts. Approval times range from a few days in states with online filing to several months in New York.

Every bit your business grows, you may also demand to register to do business in states beyond your domestic land — a process known equally foreign qualification. This involves a simpler registration process through the secretarial assistant of state. In states beyond your home state, your business is considered a strange entity.

Consider the following when registering your concern:

- Check all required steps: In some states, businesses must complete certain steps before registration, such as getting a license or securing name blessing. If you piece of work in an industry that requires any kind of license, check these requirements before registration to ensure that you complete filings in the prescribed gild.

- Follow the directions carefully: Read all instructions advisedly, equally a unmarried error in your awarding may result in a rejected application. In improver to delaying your approval, this tin can drive upwards the costs of your filings.

- Check for initial reports: Some states require businesses to file initial reports with the secretarial assistant of land, while nigh require periodic reports commencement in subsequent years. Be sure to check for these requirements on your secretary of state website.

Footstep five: Engage a registered agent

Equally part of registration, you volition need to provide a registered agent address where legal documents and official notices may be delivered to your business concern. This must be a physical address where someone is available during business hours to accept delivery of documents.

Following are all-time practices for appointing a registered amanuensis:

- Hire a pro: You tin use your business address as your registered agent accost, but you're better off appointing a professional registered agent service. Fees are affordable and it spares you lot the possibility of having someone show up at your identify of business organisation to serve notice of a lawsuit.

- Choose a nationwide service: If you lot choose a company that provides nationwide registered agent service, you tin utilize the aforementioned service in other states every bit your business concern grows.

Step 6: Register for taxes

By and large, y'all need to register for taxes in states where you have taxation nexus, which is a sufficient presence to trigger taxation obligations. Typically, this includes owning business property, transacting business, running facilities, hiring employees, or having significant sales in the state.

For sales revenue enhancement, you don't have to accept a POS arrangement or agile sales force in the country to owe taxes. You may accept revenue enhancement nexus with or without a physical presence.

Depending on your operations, you may need to register for a mix of employment, sales and use, corporate income, and franchise taxes.

This generally involves applying for a federal employer identification number or other tax identification through the state revenue department and and so completing periodic filings to pay taxes due.

Consider the following when registering your business for taxes:

- State income and franchise taxes: Forty-four states levy state income taxes. Some states impose a apartment franchise tax for the privilege of doing business concern. California, for case, collects a minimum annual franchise tax of $800 on every LLC or corporation doing business organisation in the country.

- Sales and utilise taxation: In any state where you accept taxable sales, yous'll need to enquiry sales and apply tax requirements and potentially annals. If you have significant sales in remote states, you may need to register and remit sales taxes at that place as well. Wholesale distributors may need to apply for a reseller's certificate. Check state revenue department websites for thresholds and requirements.

- Employment taxes: In states where yous accept employees, you will demand to register for state payroll taxes.You may likewise exist required to register with the state labor department for workers' bounty and unemployment insurance.

- Local taxes: In addition to land taxes, your business may demand to be registered at the county and municipal levels, too.

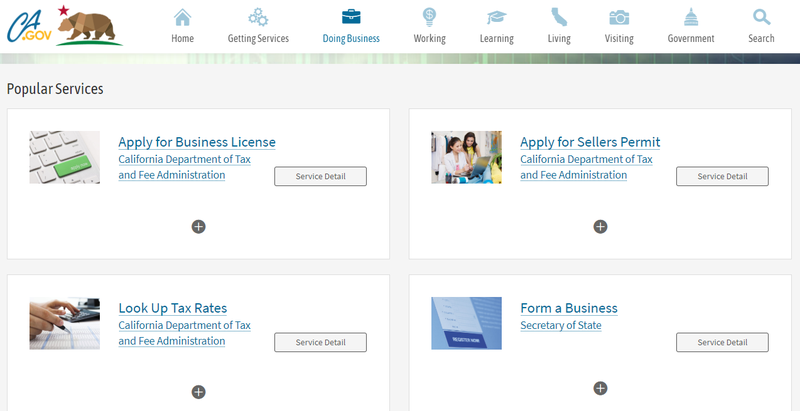

Most state websites have dynamic concern hubs that point you to the forms and resources you demand to register your business organization.

Step 7: Larn licenses

Some states, such as Alaska and Nevada have general business organization licenses. Others only require licenses for sure professions or activities. In some states, business organisation licenses must be obtained before registration, while in others, the order is reversed.

That's why information technology's important to cheque licensing requirements earlier you file registration paperwork.

To ensure that your business is properly licensed, consider these practices:

- Start with land business hubs: Most land websites feature business licensing and registration information adjacent, making it easy to inquiry requirements and gather the required forms.

- Check for prerequisites: Licensing and registration are often intermingled, so make sure you're following the steps in the right order.

- Read the fine print: With each class you have to file, read all the instructions before starting your work. Some requirements are non all that clear from the forms themselves, but they're usually spelled out somewhere on the site. Often asked questions are e'er worth skimming, too.

Get in official

While meliorate times tin can be had (possibly even at the dentist), filing that completed registration bundle is a major milestone in the growth of your business.

Fortunately, states want you selling, hiring, and growing within their borders, so they include most of the information and resources you need on their websites. When y'all're set up to have that big stride and brand your business official, accept advantage of those free resources to make information technology equally like shooting fish in a barrel as possible.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

Source: https://www.fool.com/the-blueprint/how-to-register-a-business/

Posted by: contrerasknitted.blogspot.com

0 Response to "What Should I Register My Business As"

Post a Comment